Business Insurance in and around Stoughton

Calling all small business owners of Stoughton!

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

Operating your small business takes commitment, dedication, and excellent insurance. That's why State Farm offers coverage options like errors and omissions liability, extra liability coverage, a surety or fidelity bond, and more!

Calling all small business owners of Stoughton!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a veterinarian, an antique store or a barber shop. Agent Abbey Welsh is also a business owner and understands your needs. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

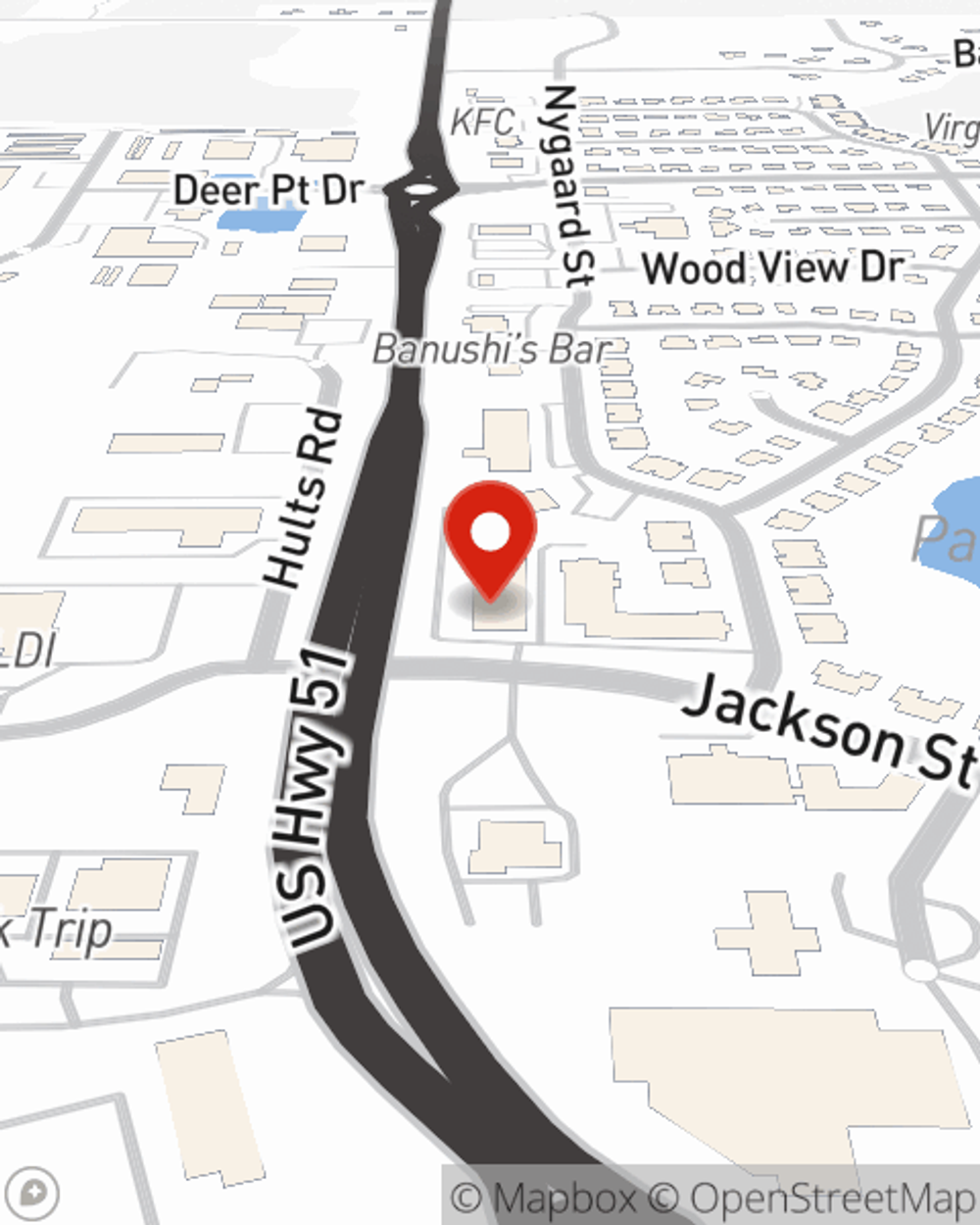

Agent Abbey Welsh is here to review your business insurance options with you. Call or email Abbey Welsh today!

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Abbey Welsh

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.